Are Coding Bootcamps Tax Deductible?

With the April 15th deadline quickly approaching, our grads and prospective students are asking whether their bootcamp tuition is tax deductible. Because most coding bootcamps are accredited on a state level, not federally, the answer isn't always clear.

Read on for more information, or check out IRS Publication 970 (Tax Benefits for Education) to go straight to the source. As with any financial decision, we recommend that you seek advice from a CPA if you're unsure whether tuition qualifies for a deduction on your tax returns.

How to Determine if Your Bootcamp Is Tax Deductible

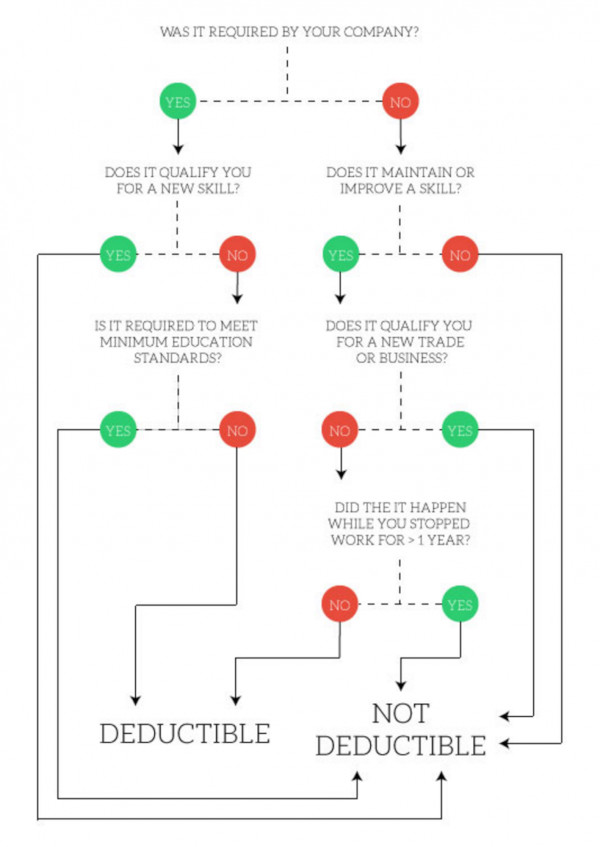

Tuition is deductible if your current salary, position or employment will be adversly affected if you do not receive the training you paid for. That said, there are 2 conditions: a) if the training program qualifies you for a new skill, it is not deductible, and b) if the training is required to meet minimum education requirements for a job, it is not deductible.

Basically, if the education is necessary to maintain the status quo, it may be deductible, but if you are learning a new trade (programming) or otherwise advancing your current position, it may not be deductible.

To provide a couple of examples:

- If you are a PHP developer and your boss requires that you learn JavaScript and Node.js, tuition is deductible.

- If you are a marketing manager and your boss asks that you learn to code, it is not tax deductible because you are learning a completely new skill.

- If you are a developer contractor and you learn Node.js to satisfy your clients' continual demands for the latest and greatest, tuition is deductible.

The government's position on the subject essentially boils down to this: If you're learning in order to maintain your current vocation and prevent your skills from becoming outdated, your tuition is likely tax deductible, no matter whether or not your employer required the training. If you're learning something completely new, like a lawyer switching gears towards software engineering—something we see fairly often—tuition is likely not deductible.

One other big caveat involves duration of time away from work during which the training takes place. For example, if you are a developer by trade, and then you take more than a year off to pursue your dream career in Hollywood, but it doesn't work out so you decide to reenter your former tech vocation via a bootcamp's retraining program, tuition is likely not deductible because you left the industry for more than one year.

Here's a great diagram that helps explain the situation:

Image credit: wefinance.co

Can I Use a 529 Plan to Pay for My Bootcamp?

To help round out the discussion, I'd like to address 529 plans, also calledqualified tuition programs or Section 529 plans.There are a lot of tax benefits to a 529 plan,and we often get questions from prospective students about whether they can use oneto pay for their bootcamp tuition.

In the past, 529 plans could only be used for post-secondary education such as colleges and universities. As of 2017, 529 funds could be used to cover K-12 education and the program was expanded again in 2019 to include apprenticeship programs.

All of this may make it sound like a 529 account is a great way to pay for your coding bootcamp education, but unless a bootcampis provided through an eligible college or university, it is not eligible to receive 529 funds. Mostcoding bootcamps like DigitalCrafts are considered non-accredited, certificate-granting post-secondary programs, so a 529 plan is not applicable.

Ways to Pay For Your Bootcamp Education

If you're researching how to pay for your bootcamp education, check out these resources:

Ready to take the next step in your career? Learn more about our programs.

DigitalCrafts Bootcamps

This post was updated Feb 2021.